Dave Stangis and I go back to the 1990’s when we worked together at Intel Corporation. These were the early days of the corporate sustainability movement, and there was no established playbook.

Fast forward to today, and Dave is an “OG” of the practice. As he prepares to transition from his role as Chief Sustainability Officer at Apollo Global Management - one of the world’s largest private capital firms - we caught up recently to gather his thoughts on the state of the profession. We also heard from Dave’s successor at Apollo - Jaycee Pribulsky - as she takes the reins.

1. You’ve built Sustainability & ESG programs from the ground up across multiple Fortune 100s. What’s the common thread between sustained success across the sectors you’ve worked in and what tends to derail progress?

Dave: The common thread lies in both team and organizational leadership that connects sustainability to business value. Across sectors, progress happens when sustainability is integrated into how a company wins, not as an add-on. Success comes from embedding sustainability capabilities and value creation into strategy, governance, and capital allocation.

What derails progress is fragmentation – when the work becomes reactive, disconnected from performance, or overly focused on optics rather than outcomes. The organizations that endure are those that treat sustainability as a system of continuous improvement and competitive differentiation.

2. You’ve worked as a CSO for multiple decades. How has the role evolved during that time? What are some of the take-home messages you are sharing during this transition at Apollo?

Dave: The role has evolved from “championing a concept” to a systems and operations approach; more of a “chief integrator.” Early on, sustainability was about data, reporting and engagement. Then it evolved to an era of goal setting and communications. Today, all of those elements are important, but in leading businesses it’s about capital flow, risk management, and value creation.

At Apollo, that means building durable systems that make sustainability part of every investment decision, portfolio company playbook, and financing structure. I came to Apollo to build an approach, team, and management system designed to serve the company as it grows and competes in ever-changing markets.

My message during this transition is direct: focus on execution and system integration. Sustainability can be a competitive advantage when it’s built with intention and the company’s vision in mind. It’s been a privilege to help build Apollo’s sustainability foundation and a system that’s rigorous, commercial, and adaptable. With Jaycee stepping in, the function is positioned to scale even further. The team, the platform, and the mindset are in place for the next chapter.

3. At Apollo, you’re responsible for building sustainability infrastructure across hundreds of portfolio companies. What prompts portcos to be more sustainable, and how do you build those systems at scale?

Dave: It starts with the deep expertise on Apollo’s Responsible & Sustainable Operations team and then leans into materiality and motivation. Portfolio companies act when sustainability aligns with their own growth plans, resilience, or capital access. Our job is to make that link explicit.

Jaycee: At Apollo, scale is critical. We create the governance models, performance infrastructure, and data systems that are built to be repeatable across industries. The team translates complex global expectations into practical playbooks for operators.

4. How does this strategic buildout look different on the Credit and Platforms side of Apollo?

Dave: Each business line has a distinct lever. For our Sustainable Credit and Platforms Team, it’s about integrating sustainability into underwriting, engagement, and LP reporting that helps issuers and borrowers future-proof their business models. It’s about building scale and tools to enable our deal teams to accelerate innovation, clean infrastructure, and resilience across industries they invest in.

Jaycee: Integration is central to our approach. We utilize consistent principles, process integration, and data-driven insights to capture environmental, social, and governance issues relevant to investment performance.

5. We’ve seen a global pushback on sustainability this year. How are private market investors thinking differently about sustainability in 2025?

Dave: Private capital has the advantage of a longer-term view. While the public debate may fluctuate, our focus is on fundamentals – risk assessment & management, excess return for unit of risk, and resilience. Sustainability helps us assess value creation pathways, price risk more effectively, and unlock new markets.

Jaycee: Apollo’s approach remains focused on long-term value creation – for our investors, the companies that we own and partner with, and the many other stakeholders that can benefit. We’ve built a pragmatic commercial approach that drives performance and manages risk and that’s where we will continue to differentiate.

6. Apollo has committed to $100 billion in clean energy and climate investments by 2030. As climate policies become politicized, do you see the calculus around clean investments changing, and are you still bullish around the green economy?

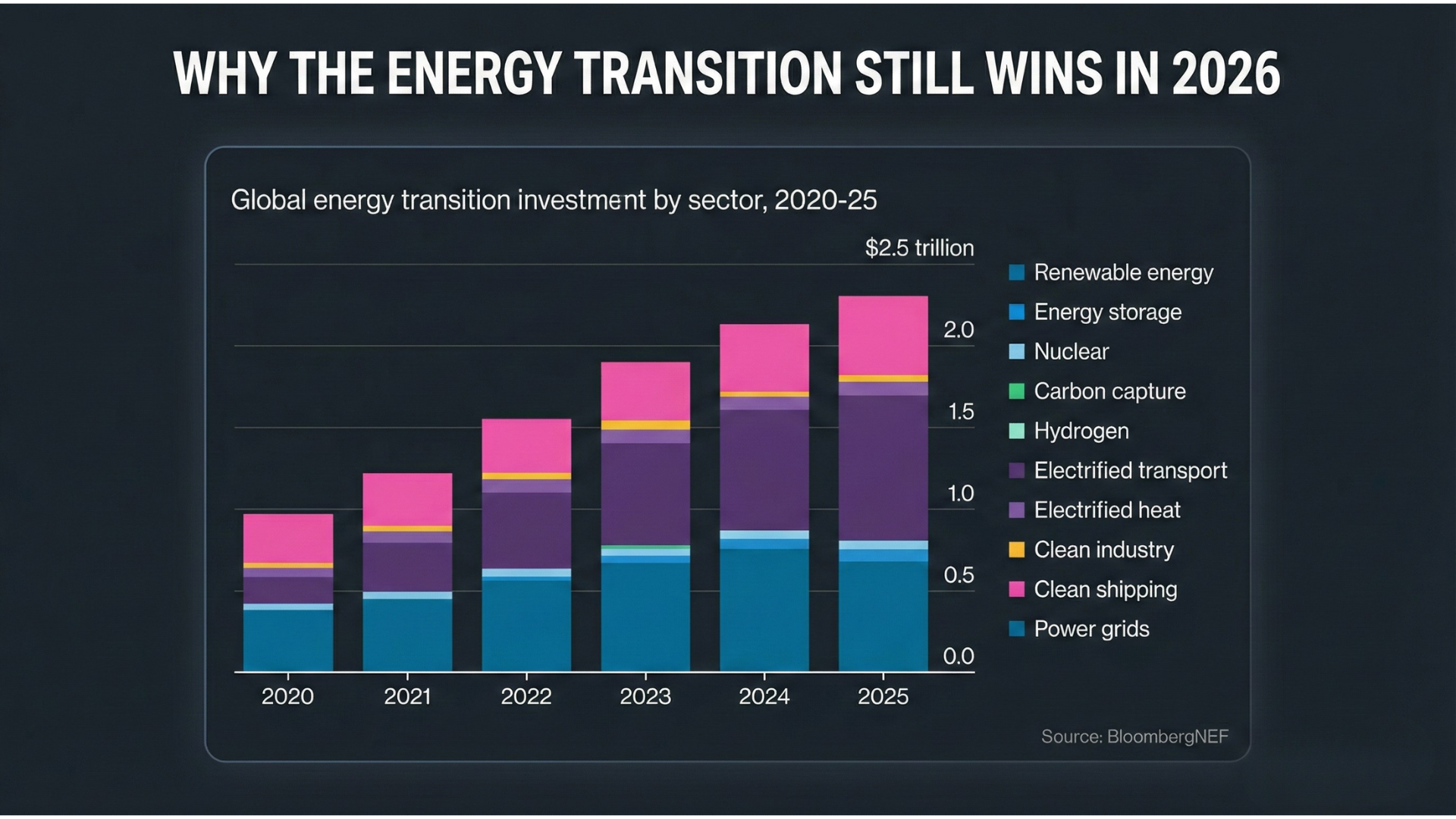

Dave: I am absolutely bullish because the economics are there. The energy transition is a global industrial transformation, not a policy experiment. Apollo is focused on the real economy: deploying capital into assets, companies, and technologies that can scale profitably and sustainably.

Policy can accelerate or slow the pace, but the direction is clear. Demand for cleaner, more resilient infrastructure is growing across sectors and geographies. The opportunity is in the execution and building solutions that perform in any policy environment.

Jaycee: What we refer to as the Global Industrial Renaissance – a once-in-a-century transformation – will require an estimated $75–100 trillion in capital for infrastructure, utilities, and decarbonization by 2050. As of September 2025, Apollo-managed funds have already committed, deployed, or arranged over $69 billion toward energy transition, infrastructure, and sustainability-related investments – well on our way to meeting our $100B goal. And we see continued opportunity – energy demand is growing at the fastest rate in 30 years, and we have long-range, flexible capital solutions to deploy.

7. Looking ahead, where do you see the biggest opportunities for sustainability to drive competitive advantage in the private markets?

Dave: I’m incredibly proud of the strides we’ve made to embed sustainability into our processes, investment diligence, and value creation, which I believe will be the standard for outperformance going forward.

Jaycee: We have entered the next phase of operationalizing sustainability. And the opportunity at Apollo is through leverage – of our scale, flexible capital structure, and technical expertise – to create long-term value. This is an exciting moment in private capital and I look forward to helping shape the next chapter.