The energy transition continues despite policy headwinds

Investments in cleantech set records

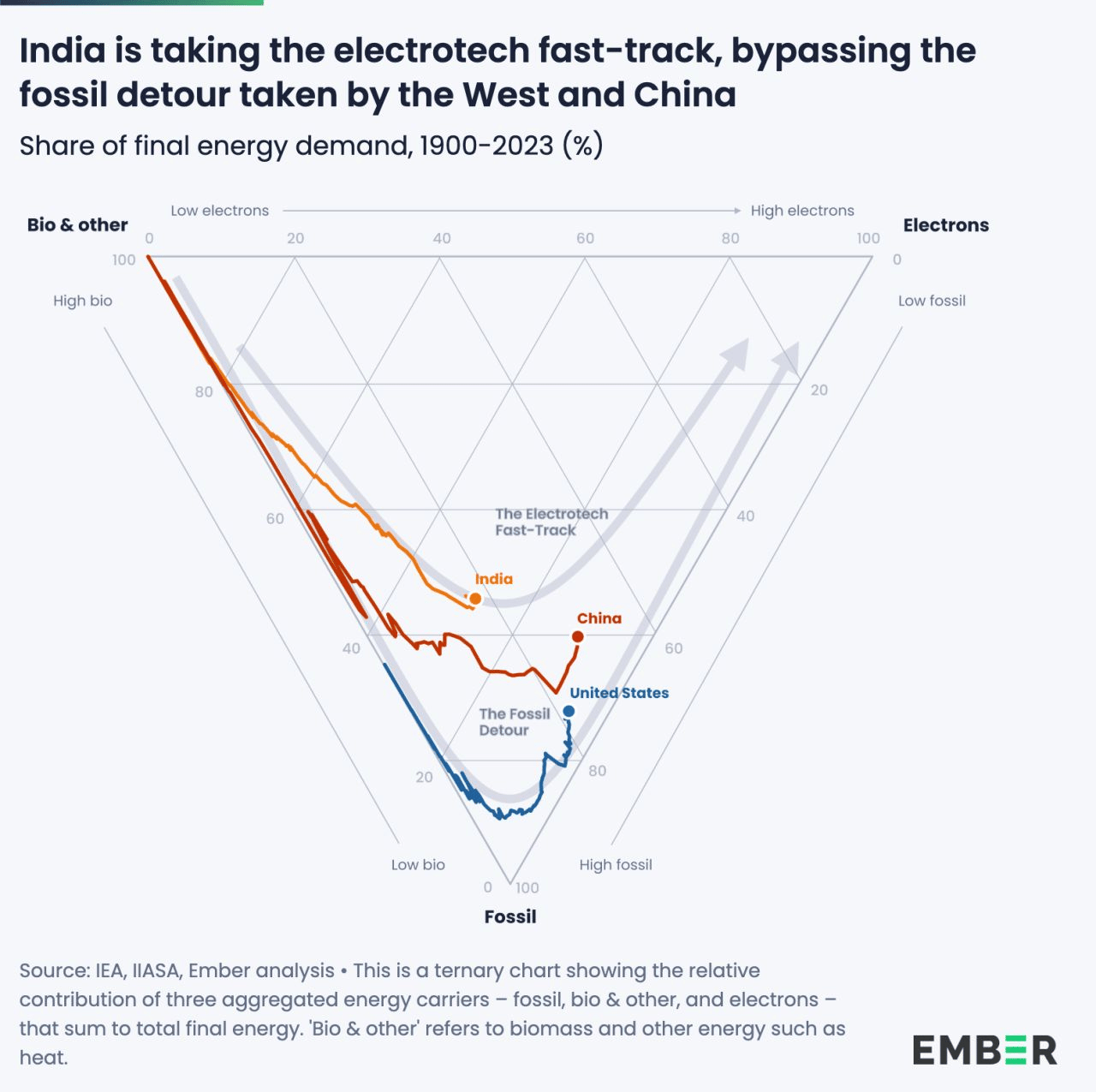

India skips over fossil fuels on its way to “clean” industrialization

China’s new climate disclosure rule

10,000 companies have climate targets aligned with the Paris Accord

The Trump administration officially removed itself from the Paris Accord this week (again!). Tax credits for clean tech under the Inflation Reduction Act are set to dry up this year as a result of the One Big Beautiful Bill Act, and the Administration continues its attempts to block US wind projects. Given these factors, you would be forgiven for a bearish outlook on clean tech in 2026.

However, power consumption is increasing for the first time in years, with projections that total US electricity demand could rise by 25% by 2030 compared with 2023. The need for all forms of generation, coupled with pushback from the combination of renewable companies, US states, investors, and manufacturers, leads to a decidedly positive outlook for clean tech in the US.

Here are three reasons to be bullish about US clean tech in 2026 and beyond:

Litigation: This week, a judge allowed another offshore wind project blocked by the Trump administration to move ahead. The $4.5 billion project off the coast of Martha’s Vineyard, Massachusetts, which is 95% completed and will power 400,000 homes, will now be able to restart construction. It joins three other projects in Virginia, Rhode Island, and New York, where federal judges have allowed construction to continue after federal blocks. States are also taking to the courts. Michigan joined multiple other states suing oil giants for their role in suppressing renewable projects and ensuring energy costs remain high.

Plummeting costs: The levelized cost of solar in North America is around $50 per megawatt-hour. Onshore wind costs $76 per megawatt-hour. Whereas natural gas-fired power costs $115 and coal costs $194 (that's not counting the costs of carbon pollution). This is why solar met 61% of new energy demand growth in the US last year. And why, despite the policy headwinds, the International Energy Information Administration (EIA) released a report last week indicating that solar and wind will meet most of the global increase in energy demand over the next 2 years. Increasing by 46% and 12%, respectively, whereas coal-based electricity generation will drop 8%.

Opportunities in the green economy: The AI boom continues to drive electricity demand, but is also driving the market for clean tech to both build and power AI data centers. Renewable power is not only cheaper, but can be deployed quickly to meet rapidly rising demand. New fossil-fueled and nuclear generation requires over 5 years' lead time. In 2025, investors poured $40 billion into climate-tech startups, up 8% from the previous year. The US saw its biggest jump in three years, up 27%.

Unfortunately, the US is no longer prioritizing the policy tools to mitigate the worst impacts of climate change, which slows the energy transition and gives foreign competitors a leg up. China has added more energy to its grid in the last four years than the entire current U.S. capacity, with solar accounting for more than half of the new additions last year, while wind, coal, and natural gas generation were also at records.

This Administration will continue to limit the energy transition, but economic pragmatism and growing demand is driving a red hot renewables market…at least for now.

👉 Prefer to get Sustainability Simplified straight into your inbox instead of LinkedIn? Sign up to our email list here.

2. Record Energy Transition Investment

Clean tech investment continues to accelerate globally. This week, a BloombergNEF report found that a record $2.3 trillion was invested into the energy transition in 2025, up 8% from 2024. The majority of the investments were in electric vehicles (EVs) and EV infrastructure. This was the second consecutive year in which clean energy investments outpaced fossil fuel investments, and the gap is widening.

2025 was also a record year for EV adoption. Globally, EV sales increased 20% in 2025. In Europe, despite softer climate rules, EV sales grew 30% to a record high, outselling petrol cars for the first time for parts of the year. A new €3 billion subsidy in Germany, Europe’s largest auto market, is set to grow EV sales even more in 2026.

Tariffs and trade tensions are further accelerating the adoption of renewable energy as countries shift their focus to energy security. Nine EU countries this week agreed to an offshore wind grid that will, for the first time, be connected to more than one country. The EU suggested this is in part due to U.S. threats against Greenland, as they did not want to “swap one dependency with a new dependency,” referring to reliance on US natural gas after weaning away from Russian gas.

3. India Bypassing Fossil Fuels

This compelling graph from the energy think tank Ember shows that the world’s third-largest emitter, the most populated country, and fastest-growing major economy - India - will industrialize without taking the same fossil-fuel “detour” as China and the West. The analysis compares energy paths at equivalent levels of economic development. It finds that plummeting costs are enabling India to adopt solar, EVs, and widespread electrification at a much faster pace than China at the same stage of development.

The boom in clean energy made 2025 the first year since the 1970s in which coal use in both China and India declined. India saw a 3% drop in 2024. It was also the first year in which more than 50% of India’s energy came from non-fossil sources, strengthening its energy security. India’s outdated electricity grid is limiting solar expansion and slowing new generation projects.

4. China’s New Climate Disclosure Rules

In addition to its lead in climate technologies, the Chinese government is seeking to increase transparency around corporate climate performance. In late December, China’s financial regulators issued a voluntary rule for climate disclosures. The rule largely aligns with the International Sustainability Standards Board’s (ISSB) climate-related disclosure standard (S2), with unique elements, including an EU-style double materiality requirement.

The rule has been well received in the investment community for its ambition and well-thought-out updates compared to the original 2024 draft. Relevant updates include:

A requirement for companies to disclose how their climate actions align with China’s nationally determined contribution (NDC) under the Paris Accord (reduce emissions by 7-10% from peak levels by 2035).

Simplifying certain parts of Scope 3 reporting, around facilitated emissions.

Aligning with China’s emissions trading scheme.

Three of China’s largest stock markets already have mandatory sustainability reporting rules, which cover around 450 companies. However, the Chinese government plans to make this new climate reporting rule, which was finalized two years ahead of schedule, mandatory for large listed firms in the coming years. The government is also developing sector-specific guidelines for hard-to-abate sectors.

Karine Hirn, of East Capital Group, said China’s reporting rules were in “a stark contrast to the ESG backlash in the US and the watering down of European disclosure regulations.” Adding that “Investors will welcome the alignment with ISSB standards, which will make it easier for foreign analysts to gain a better understanding of the sustainability standards of Chinese companies, which is often better than people think.”

5. SBTi Reaches 10,000 Validations

On the eve of releasing their new Net Zero Standard, the Science Based Target Initiative (SBTi) reached a milestone of 10,000 companies with validated net-zero goals. 2,800 companies were validated in 2025 alone - bringing the total to more than 10,000.

Companies with validated targets now make up 40% of global market capitalization across 90 countries. Stated another way: 40% of the global economy is committed to achieving net zero emissions by 2050. Europe continues to dominate with the most aligned companies, but the Asian market has accelerated in recent years.

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

U.S. Carbon Border Tariff

CDP Reporting

Sustainability Research

AI

Trump 2.0

Notable Podcasts:

My colleagues and I at BCG are hosting a webinar on what the updated European Sustainability Reporting Rules (ESRS) mean for business.

In the most recent episode of Pitching Progress, my BCG colleague Vinay Shandal discusses a more efficient way to heat and cool our cities. To explore this topic, he talks to Carlyle Coutinho, the CEO of Enwave, a company helping Canadian municipalities find more sustainable heating and cooling, like piping Lake Ontario into buildings in Toronto.