Five sustainability signals from WEF’s annual event in Davos

Europe’s pivot to incentives looks to leverage its sustainability advantage

Europe's finance sector focused on climate risks and preventing greenwashing

The business community’s deafening silence on Trump policies

The year of disclosure: Four new due diligence laws in Asia

Each year, the global elite descend on the picturesque Swiss ski town of Davos for the World Economic Forum’s (WEF) annual meeting. Heads of state, Nobel prize winners, and thought leaders of all stripes gather to discuss our shared economic problems and offer solutions.

WEF states, “the purpose of the meeting is not formal decision-making like a treaty conference, but rather to facilitate conversation, collaboration, and partnership among sectors in order to shape global, regional and industry agendas.”

Having been to a few of these confabs, this year seems to have reached beyond conversation, collaboration, and partnership. Most of our very switched-on readers are up to speed with the headlines of how this year’s meeting is reshaping the geopolitical landscape. And, if you only read one thing today (in addition to this newsletter of course) - read Canadian Prime Minister (and former climate warrior) Mark Carney’s speech for a clear, passionate, and eloquent description of the new world order.

While geopolitics and AI have taken center stage, there are some emerging signals about the future of sustainability. Energy is a hot topic, and one of the event's main themes is “How can we build prosperity within planetary boundaries?”

Our crack team sifted through the noise to bring you five sustainability signals from this year's WEF annual meeting:

The US pushes fossil fuels: President Trump continued to call clean energy “a hoax” and “the green new scam.” He falsely claimed that China produces wind turbines but has no wind farms (it has the most globally by far). US Commerce Secretary Howard Lutnick pushed for more coal rather than renewables at a private dinner. This prompted heckles, including from ex-Vice President Al Gore, who said, “I sat and listened to his remarks. I didn’t interrupt him in any way. It’s no secret that I think this administration’s energy policy is insane. And at the end of his speech, I reacted with how I felt.”

China seeks to be the center of green multilateralism: In stark contrast to the U.S., China used its attendance at this year’s event to invite global stakeholders to embrace the opportunities in the green economy. In his speech, Chinese Vice Premier He Lifeng asked for collaboration with China as they “pursue green development and share with the world the opportunities.”

Corporate sustainability realism: As the world recalibrates sustainability goals amid other competing priorities, such as AI and tariffs, corporations are reframing sustainability as a profit driver. PepsiCo CEO Ramon Laguarta said that companies need to see that the debate should not be about sustainability or profitability, and added that “growth is our business model [at Pepsi], but growth for the long term means that we [must avoid] depleting the resources that will give us future growth.”

Adaptation moves up the priority ladder: While mitigation of climate change has become politicized this year, climate change adaptation and resilience gained momentum because it is less controversial. Attendees noticed the shift. Nicolás Galarza, a former environment minister in Colombia, claimed, “It’s the middle ground, to avoid confrontation with Trump.”

WEF’s Year of Water: This year’s Davos has been dubbed “Blue Davos,” as it kicks off the WEF’s Year of Water. The focus on water comes at a critical time: A landmark UN report revealed that the planet is entering a “water bankruptcy” phase, where fresh water is being depleted faster than it is replenished, and many critical waterways are polluted beyond repair. This is also the first year of the High Seas Treaty, a global agreement to protect biodiversity in international waters.

While climate and sustainability may not have been the headline of this year’s Davos. It will inevitably re-emerge as a top priority. WEF’s own risk report last week showed that sustainability-related risks will dominate over the 10-year time scale.

As Abraham Maslow predicted in his famous hierarchy of needs, when security is in question, very little else matters. While environmental risks are dire, because they are longer-term, the world is prioritizing safety and security for now. Yet, the signals coming from Davos show that there is still a lot of action to advance sustainability.

👉 Prefer to get Sustainability Simplified straight into your inbox instead of LinkedIn? Sign up to our email list here.

2. Europe Pivots to Cleantech Incentives

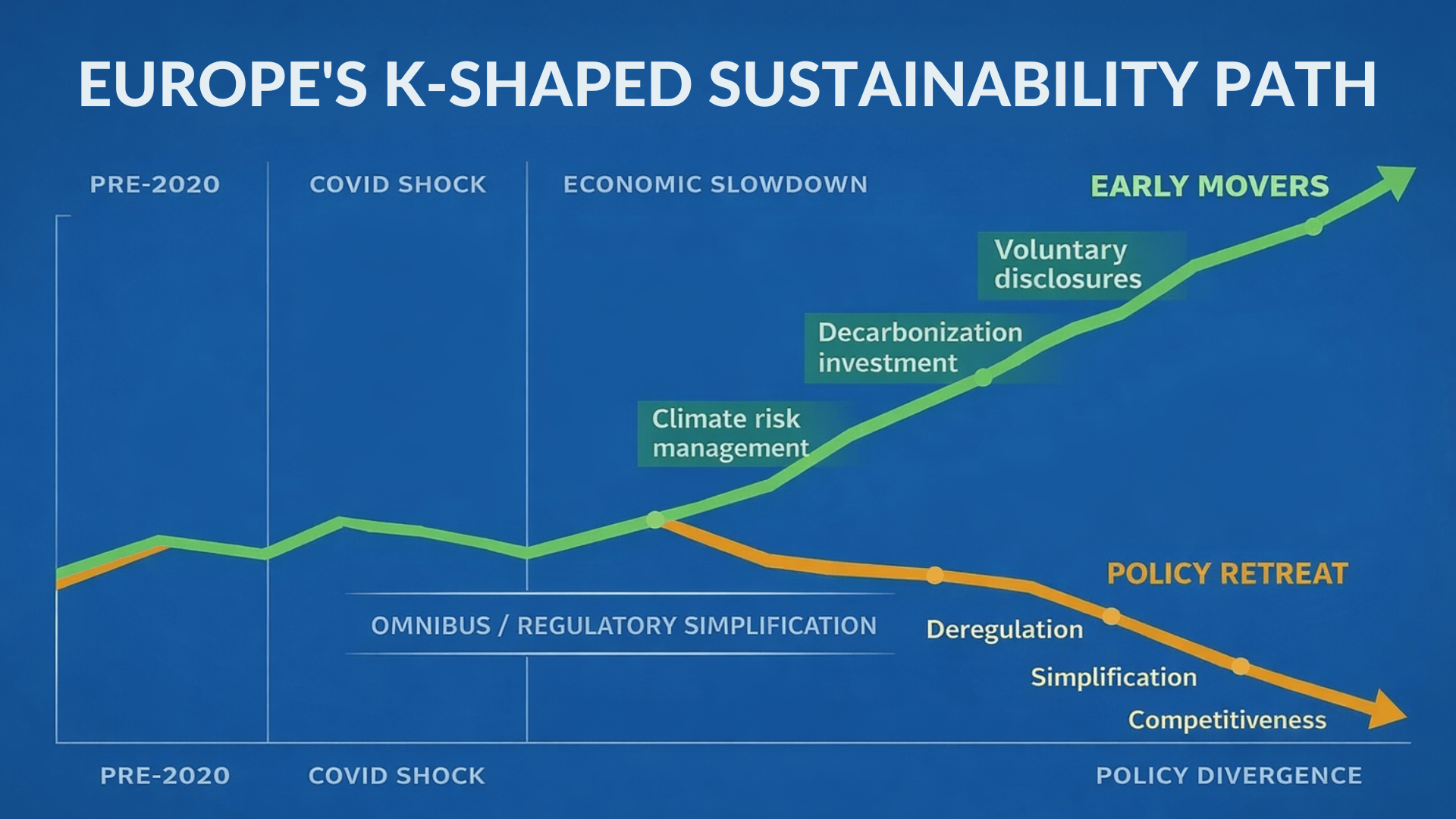

The EU’s Omnibus Simplification process may have weakened many of its sustainability rules. However, a new EU proposal expected late February would continue Europe’s leadership in decarbonization and leverage it as a competitive advantage, especially in hard-to-abate sectors.

This week, a leaked draft of the Industrial Accelerator Act, previously known as the Industrial Decarbonisation Accelerator Act, revealed that the EU plans to use a 'Made in Europe' requirement on key green-tech to challenge cheaper Chinese imports. The proposal, which is designed to “ensure that the climate transition becomes an engine of industrial prosperity rather than a source of de-industrialisation," will create public procurement rules for industrial goods, like batteries, cement, and EVs, considered critical for competitiveness.

The proposal would also introduce a ‘low-carbon label’ initially for cement and steel. The EU hopes the label will carry a green premium, allowing manufacturers of green cement and steel to sell at higher prices. The proposal is expected to pass in February, but some detractors are worried about potentially higher costs for end consumers.

3. EU Financial System Focuses on Climate Risks and Greenwashing

Europe’s two primary financial bodies, the European Central Bank (ECB) and the European Securities and Markets Authority (ESMA), issued new plans to address climate risk and greenwashing.

The ECB, in its next two-year plan, aims to increase its resilience to physical climate risks by strengthening monitoring, further assessing the impact of water- and nature-related risks, and supporting the transition to a green economy. This follows a successful 2024-25 that delivered improvements in nature-based considerations, enhanced climate risk data and analysis, and strengthened the banking sector’s resilience.

ESMA’s new guidance, “on clear, fair, and non-misleading sustainability-related claims,” is aimed at helping investors avoid greenwashing in sustainable investing. The guide outlines four principles to follow, along with dos and don’ts to help investors determine genuine claims.

4. The Deafening Silence of the Business Community

Last year, greenhushing reached a peak. Calling out the muted response directly in a viral Wall Street Journal article, former US Secretary of the Treasury Robert Rubin questions whether the current Administration’s pressure on businesses is compatible with a free market and asks business leaders what it will take for them to speak out.

In another article, one reporter compared the condemnation from the business world when Trump left the Paris Agreement in his first term to today’s “walking on eggshells,” when he recently pulled the US out of the UN Framework Convention on Climate Change (UNFCCC). Concluding that, in the end, silence is self-defeating, it undermines the true financial risks businesses face from climate change.

Confirming the source of the silence, the FT revealed this week that Nestlé CEO Philipp Navratil conceded that the silence on sustainability was partly his fault, but also “President Trump’s fault.” He added, “We have not stepped back from it [sustainability], but we have to talk about it more.” However, that is not true for all companies. Many are now using this silence as a smoke screen to weaken goals and leave action groups.

5. 2026: The Year of Disclosure

2026 has been dubbed the “year of disclosure” as around a dozen jurisdictions begin enforcing mandated sustainability reporting. Despite the EU's weakening of its due diligence and reporting rules earlier this year, it appears supply chain due diligence may be the next priority for global governments.

Asia is now the epicenter of these rules, where four countries are advancing supply chain due diligence mandates for their biggest companies:

Thailand: Thailand’s Act on the Promotion of Responsible Business Conduct is expected to be introduced in the legislative process early this year. It will require all large Thai enterprises to conduct due diligence in their supply chains, ensuring that no environmental harm occurs and that human rights are respected. Impacted companies will have to share a due diligence report or face fines.

South Korea: The Legislative Bill: Protection of Human Rights and the Environment for Sustainable Business Management will impact Korean companies with more than 1,000 employees. It will require them to systematically prevent and mitigate human rights and environmental risks arising from business activities and supply chain management, and report their due diligence and mitigation annually, or face fines. The proposal will take effect 2 years after it passes.

Indonesia: Indonesia’s National Strategy on Business and Human Rights and Expectations in Relation to Human Rights Due Diligence could become a law as early as the end of Q1 2026. It will require Indonesian businesses to conduct due diligence on human rights and environmental impacts, or face penalties.

Malaysia: As part of Malaysia’s National Action Plan on Business and Human Rights 2025-2030, it plans to issue a corporate due diligence rule. It will require companies to report, prevent, and mitigate social and environmental issues in their supply chain.

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

ESRS

Wall Street and Climate

Sustainability Frameworks

Sustainability Research

Friends of the newsletter Leafr, CEO Gus Bartholomew, released this great report, "The True State of Sustainability," featuring insights from 50 sustainability leaders and a survey of more than 400 practitioners.

SBTi

Trump 2.0

Notable Podcasts:

In this week’s edition of the Two Steps Forward with Joel Makower and Solitaire Townsend, they discuss the power of story in sustainability communications. They share how stories are about people, something that gets lost in all of the sustainability metrics and regulations.

In this week’s episode of the Outrage and Optimism podcast, the team discusses the implications of the US withdrawing from international bodies such as the UN Framework Convention on Climate Change (UNFCCC). Sue Biniaz, former US Deputy Special Envoy for Climate Change, who claims this is not the end of multilateral climate action, reviews pathways for the US to potentially rejoin.