EU stakeholders pushback on sustainability simplifications

US SEC to curtail disclosures and review the Names Rule

First lawsuits are filed in showdown over US Endangerment Finding repeal

California goes it alone on climate

The US threatens to leave the International Energy Agency

Europe cut its sustainability rules to boost competitiveness. Now, its own institutions are questioning whether the trade-off delivers meaningful benefits, helps meet its climate goals, or drives economic growth.

Under the Omnibus Simplification process, Europe aimed to improve competitiveness by cutting red tape. But EU research found that, together, they will only save €11.9 billion per year (0.07% of EU GDP).

The cuts drastically reduced the scope of cornerstone sustainability policies: the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CS3D), and the European Sustainability Reporting Standards (ESRS).

The European Central Bank released a staff opinion last week on the revised ESRS. While they applauded aspects of the new standards, they claimed that reliefs and exemptions for financial institutions will result in “significantly reduced transparency for investors and other market participants.”

The opinion also expressed concern that the cuts made it less likely Europe would align with the standards issued by the International Sustainability Standard Board (ISSB). Another concern stemmed from the use of the Voluntary SME (VSME) standards for about 40,000 companies. Use of the VSME would make those reports incomparable and inconsistent with reports from companies reporting using the ESRS.

The European Securities and Markets Authority (ESMA), the European Insurance and Occupational Pensions Authority (EIOPA), and the European Banking Authority (EBA) jumped on the bandwagon, calling out the same issues around the ESRS. They all claim that the vagueness of reliefs could undermine the goals “of promoting disclosure of material sustainability information of high quality.”

Also this week, the European Scientific Advisory Board on Climate Change expressed “concerns over the scale and lack of proportionality in these changes, particularly in the significant reduction in scope.” Advising the EU to expand the scope of the CSRD “in a proportionate manner, informed by robust impact assessments and climate consistency checks.”

This may all be too little, too late, as these policies are unlikely to change. However, there will be a formal review in three years and, given the early pushback and the lack of significant returns, the EU may return to these rules sooner rather than later.

👉 To get the full version of Sustainability Simplified every week, sign up to our email list here.

2. SEC to Curtail More Corporate Disclosures

SEC Chair Paul Atkin

Since the US Securities and Exchange Commission (SEC) voted to end the defense of its climate reporting rule at the start of the Trump administration, SEC Chair Paul Atkins has been quickly curtailing other corporate reporting requirements.

Atkins wants what he calls the “minimum effective dose of regulation.” What that means in practice is that the Commission plans to reduce the number of executives required to report their compensation and change how companies report risks (including climate risks), and offer more safe harbors.

Additionally, the SEC is reviewing its Names Rule, which was updated during the Biden administration to include criteria to avoid greenwashing when funds are labeled as ESG or sustainability. The rule requires any fund to have 80% of its assets in a fund related to the name of that fund. However, in a recent U.S. House Financial Services Committee hearing Atkin, when asked about the Names Rule, said that his team is reviewing any rule that “adds costs to investors, to weed out things that are not fit for purpose.”

3. Endangerment Finding Showdown Begins

Last week, the U.S. Environmental Protection Agency repealed the Endangerment Finding – the legal precedent underpinning federal climate regulation. The repeal will inevitably lead to a Supreme Court showdown, and this week the litigation got started.

A group of more than a dozen environmental and health groups, from the American Public Health Association to the Environmental Defense Fund, filed challenges in the DC Circuit Court challenging the rollback. Gretchen Goldman, CEO of the Union of Concerned Scientists, said the repeal "is rooted in falsehoods, not facts, and is at complete odds with the public interest. It marks a complete dereliction of the agency's mission to protect public health.”

The plaintiffs are confident they can win their case. Dr. Georges Benjamin, CEO of the American Public Health Association, said that the “EPA’s authority to regulate greenhouse gas has already been confirmed by the Supreme Court nearly two decades ago and has constantly been reaffirmed by the courts.”

Two other suits are also in the works: One on behalf of 18 youths who claim the EPA's action was unconstitutional. Another suit led by California and Connecticut is in the planning stage and will be filed soon. Connecticut Attorney General William Tong said the states are “putting together our best possible plan of attack." The court will likely bundle all of these cases into one.

4. California’s Goes It Alone On Climate

California Governor Gavin Newsom

As the Fed scales back, the vacuum is being filled by the states. In California, some state legislators believe rescinding the Endangerment Finding could unshackle the state's ability to enact its own rules. Cottie Petrie-Norris, chair of California’s Utilities and Energy Committee, said, “There’s a certain irony that in the revocation of the endangerment finding, it actually could provide California with more latitude and more direct responsibility.”

EPA preempts state regulation to “adopt or attempt to enforce any standard relating to the control of emissions from new motor vehicles or engines.” However, legal experts believe “that argument is inconsistent” with the EPA’s repeal of the Endangerment Finding.

The state is also considering a new rule that would require oil and gas companies to cover some of the costs of accelerating home insurance coverage in response to climate-related disasters. Additionally, California Governor Gavin Newsom signed a clean energy pact with the UK, pledging to work together to deploy more clean energy, with offshore wind as a focus.

5. IEA Shows Global Energy Fracture

IEA Executive Fatih Birol

The International Energy Agency (IEA) held its biennial meeting in Paris this week. Speaking before the event, IEA executive director Fatih Birol warned of a “fracturing in the global political order. Different countries are choosing different paths in terms of energy and climate change.” His comments come hot on the heels of the repeal of the Endangerment Finding in the US and a report revealing Canada’s slowing progress on emissions under former climate champion Mark Carney.

Confirming Birol’s point about fracture, U.S. Department of Energy Chair Chris Wright threatened that the US would leave the body if it continued to be “dominated and infused with climate stuff.” A stance that was later rebuked by UK and EU ministers.

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

Sustainable Aviation

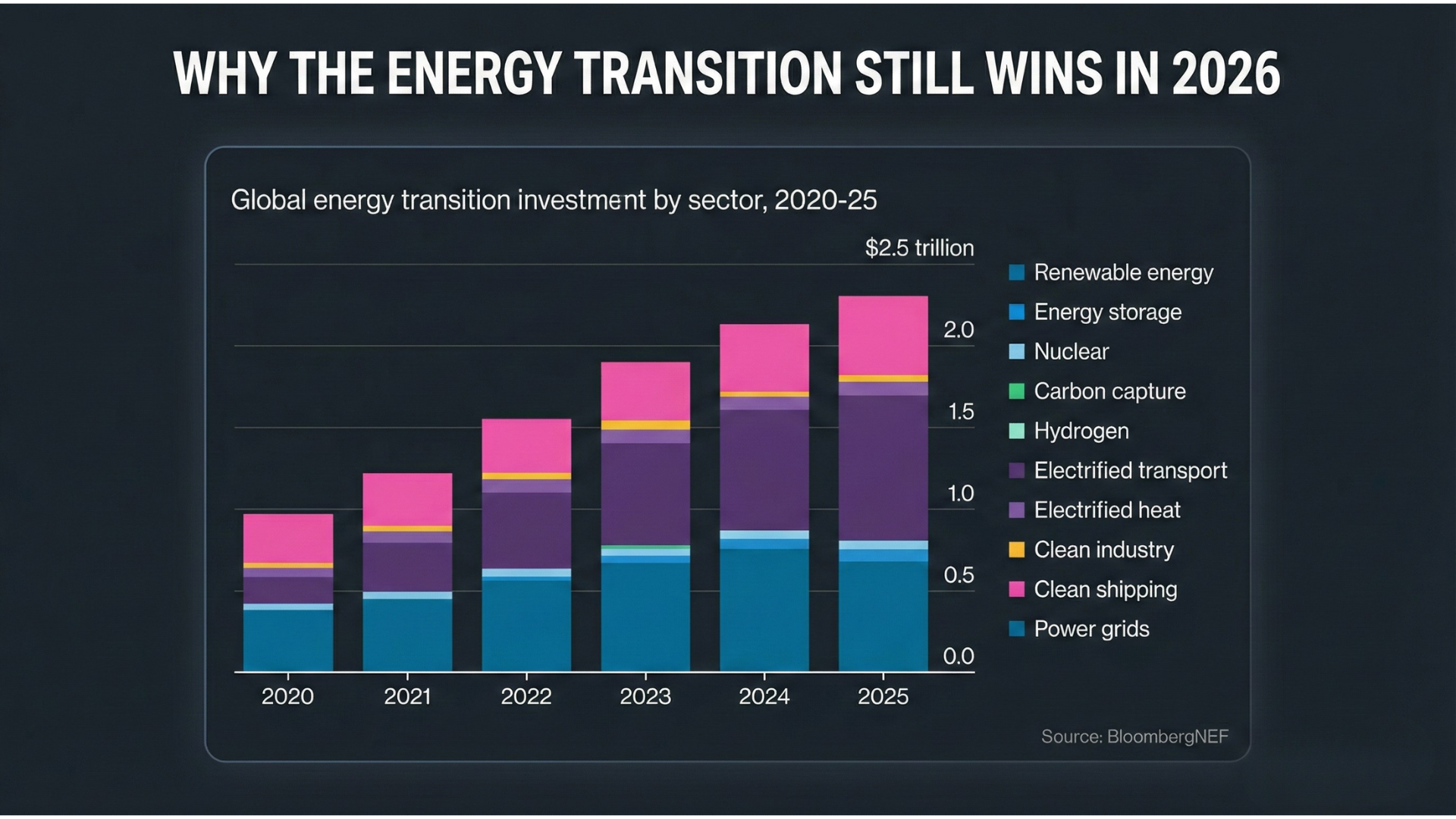

Energy Transition

ESG Backlash

Sustainability Research

EU Sustainability

ISSB Adoption

Notable Podcasts:

In the last episode of Two Steps Forward with Joel Makower and Solitaire Townsend, they discuss Interface, the flooring giant with a history of sustainability. They discuss how Interface goes beyond metrics and disclosures to get to the heart of sustainability invention and innovation.