ISO + GHG Protocol strategic partnership

EU Omnibus backlash builds momentum

World powers China and the US take opposing energy policies

DOE takes climate skepticism abroad

SEC Chair threatens non-US companies with accounting rule changes

Greenhouse Gas (GHG) accounting took a giant step forward this week as the GHG Protocol (GHG P) and the International Organization for Standardization (ISO) announced a new partnership. Under the agreement, ISO and the GHG Protocol will combine their carbon accounting standards into harmonized co-branded standards. This includes standards from the ISO 1406X family of standards, alongside the GHG Protocol Corporate Accounting and Reporting, Scope 2, and Scope 3 Standards.

A centerpiece of the new partnership is collaboration on a new product carbon footprint standard, which could be used to determine carbon tariffs due when importing goods into Europe, Britain, and many other countries with a Carbon Border Adjustment Mechanism (CBAM).

The partnership aims to integrate and streamline accounting standards, providing all entities that measure their emissions with consistent and comparable language. These objectives align with recent calls for harmonization by the B7 community, which creates business recommendations to the G7 leadership.

As jurisdictions around the world increasingly require greenhouse gas reporting, these accounting standards are critical for compliance. This means the standards for accounting and reporting must be rigorous, clear, comparable, decision-useful, and assurable.

Both the ISO and GHG Protocol leadership acknowledge that the lack of alignment has been a major barrier to climate action. Sergio Mujica, ISO Secretary General, said: “Currently, the market is flooded with burgeoning regulation, guidelines and playbooks. Yet, it stands to reason that if we’re all trying to benchmark progress towards net zero, we need the same means of measurement.

Underscoring this point, the International Sustainability Standards Board (ISSB - the baseline of 35 jurisdictions’ climate reporting mandates), the European Sustainability Reporting Standards (ESRS - used by thousands of companies doing business in Europe), and the California Air Resources Board (CARB - setting the rules for climate disclosure affecting thousands of companies doing business in California) all rely upon the GHG Protocol and ISO standards for mandatory climate disclosure.

ISSB Chair Emmanuel Faber, said: "The ISSB welcomes this development which will augment the globally accepted baseline for greenhouse gas accounting. Consistent, comparable carbon data is essential for investors globally enabling informed capital allocation decisions.”

Stakeholders are watching closely as Mathilde Crêpy, at ECOS, said that “harmonization doesn’t mean weaker rules,” and the standards are “science-based, robust and watertight against creative carbon accounting.”

👉 Prefer to get Sustainability Simplified straight into your inbox instead of LinkedIn? Sign up for our email list here.

2. The Omnibus Backlash

The “Omnibus” proceedings to simplify Europe’s sustainability rules have come under increasing scrutiny and challenges. Last week, groups of academics, corporate entities, and investors came out in support of keeping the integrity of the current sustainability rules, saying they "are a key foundation for achieving the EU's economic and sustainability goals." The statements sent to the EU include:

The Declaration of Copenhagen: More than 260 academics signed a declaration asking the EU to ensure their rulemaking is based on science, not ideology, and balances long-term benefits with short-term costs.

Investor and business joint statement on the Omnibus initiative: 475 businesses, investors, and other organizations called on EU policymakers to preserve the core of the EU sustainable finance framework. Asking for more targeted simplifications that preserve key elements, like double materiality, flexibility in value chain information sharing, and a reasonable scope for the Corporate Sustainability Reporting Directive (CSRD) at companies with 500+ employees.

The European Parliament, which just returned from summer break, is unlikely to meet the October 12th deadline to vote on the Omnibus, given the 800 amendments to be reviewed, so expect delays.

3. Bifurcating Superpowers: China vs. US

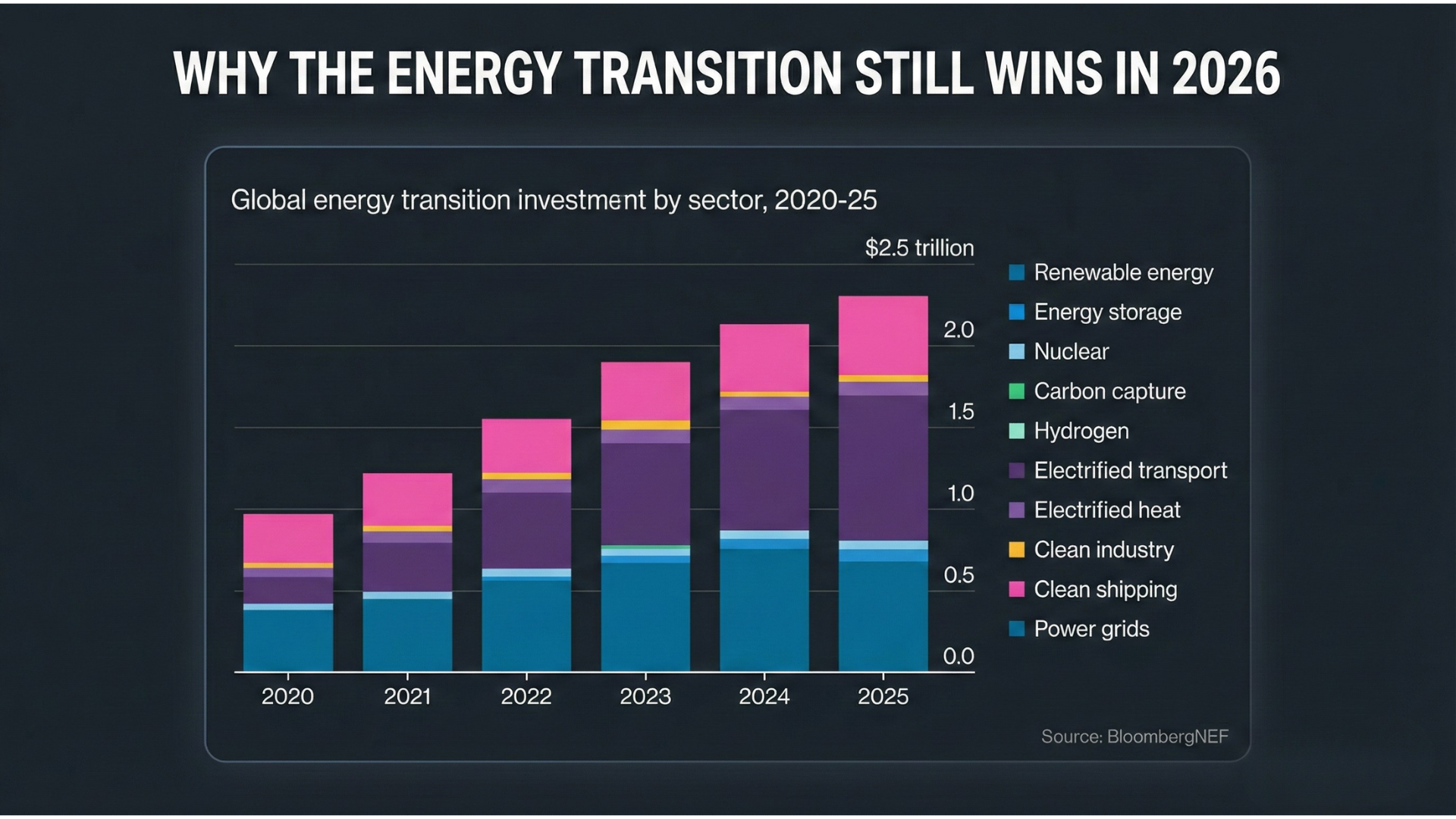

Two reports released this week showed how the world’s largest powers, China and the US, are taking very different approaches to energy and decarbonization.

A new Ember report found that China’s dominance in clean tech both at home and internationally is setting up the conditions to end the use of fossil fuels. For the first half of 2025, China’s fossil fuel use dropped by 2% due to clean tech adoption. Additionally, the influx of cheap Chinese imports enabled 63% of emerging economies to surpass the US in their share of solar power generation.

At the same time, a new report on US policies under the Trump administration found that the US rate of decarbonization could be cut in half over the next 15 years. The Rhodium study downgraded its prediction to 26-41% reduction by 2040 (down from 38-56%). While this is the 11th of Rhodium’s “Taking Stock” report, the authors noted it represents the “most abrupt shift in energy and climate policy in recent memory.”

4. US Goes on the Road With Climate Skepticism

U.S. Department of Energy Secretary Chris Wright is on a European tour touting that “the Paris Agreement is silly.”

The DOE head is pressuring his EU counterparts to weaken “overly onerous” rules on methane leakage and a law that prevents human rights and environmental damage in the production of fossil fuels.

5. New SEC Chair Threatens Accounting Rules over Sustainability

Since 2007, the U.S. Securities and Exchange Commission (SEC) has permitted non-U.S. companies to apply different accounting standards than those used by U.S. companies. The US is the only country to mandate the use of the Generally Accepted Accounting Principles (GAAP), whereas more than 140 countries use the International Financial Reporting Standards (IFRS) accounting standards. The IFRS also houses the International Sustainability Standards Board (ISSB) - which the SEC objects to.

New SEC Chair, Paul Atkin, in an address to the Inaugural OECD Roundtable on Global Financial Markets, suggested that he would not allow foreign countries to use the IFRS standards to report financial information in the US if they continue to pursue “political or social agendas” through the ISSB. Adding in an FT interview that: “Those sorts of [sustainability] principles coming into IFRS could undermine the integrity of IFRS and particularly its compatibility with [US accounting standards],”

He also went after EU sustainability regulations - specifically the impact of the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) on US companies - despite the recent EU-US trade deal adding concessions for US companies.

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

Global Weirding:

Energy Transition

Sustainability Assurance

EU Sustainability Regulations

Trump 2.0