As climate volatility accelerates, the business case for taking action becomes increasingly clear. Few leaders have been as vocal about reframing adaptation as a source of value as Himanshu Gupta, Co-Founder and CEO of ClimateAi, an AI-driven Climate Adaptation platform that helps businesses and governments anticipate risks and take relevant actions.

In this Deep Dive, Himanshu explains why adaptation must be treated as a growth engine, not a sunk cost, why Bill Gates’ views on adaptation are right but need refining, how AI can act as a force multiplier, turning resilience into the next great competitive advantage, and what the COP process can do to help.

1. You’ve described adaptation as a growth engine. How do you convince executives that climate adaptation is not just about risk—it’s about ROI?

Our inroads when we started talking to business leaders about adaptation were, until recently, all around risk, supply chain disruption, crop loss, facility downtime, and asset and infrastructure loss. But what’s changing is that companies see adaptation as one of the biggest market opportunities right now, with numerous studies over the past few years backing that up. One we often cite is from your company, BCG, and the World Economic Forum, which puts the ROI at as much as 19 dollars for every dollar invested through 2050. And we see that more of those returns are increasingly coming from competitive advantages rather than from risk mitigation. As businesses improve their market share, increase revenue, and save costs. We are even seeing governments improve their trade competitiveness.

Another important thing we are showing executives with adaptation is that returns are generated over a year or two, not over decades. We saw that with a roofing company we worked with, which adapted its supply chain logistics after we correctly predicted Hurricane Ian, helping them lock in $15 million of additional trade. When we can demonstrate this sort of quick ROI and build trust with CEOs that climate risk and ROI are not something way off in the future, we see this flywheel effect of companies investing in adaptation.

2. In Bill Gates' recent memo, he said adaptation deserves more funding, especially for the developing world. Is he right, and why does this seem like such a critical time for adaptation?

Gates is right about his diagnosis. Adaptation needs far more funding. Where I diverge is on how to treat the issue. His framing that adaptation is primarily aid for the “developing world” or a poor man’s problem - this is a missed opportunity.

The reality is that adaptation is a global economic issue for business, developed nations, and the developing world. The majority of climate-related damage today impacts the Global North and the richest coastal cities and zip codes within them. In the first half of 2025, the U.S. alone accounted for 90% of the $100 billion in insured weather losses worldwide. So, while investment must be directed to the developing world to mitigate human suffering, this is not just a developing-world problem or a poor-man’s issue that needs philanthropic support.

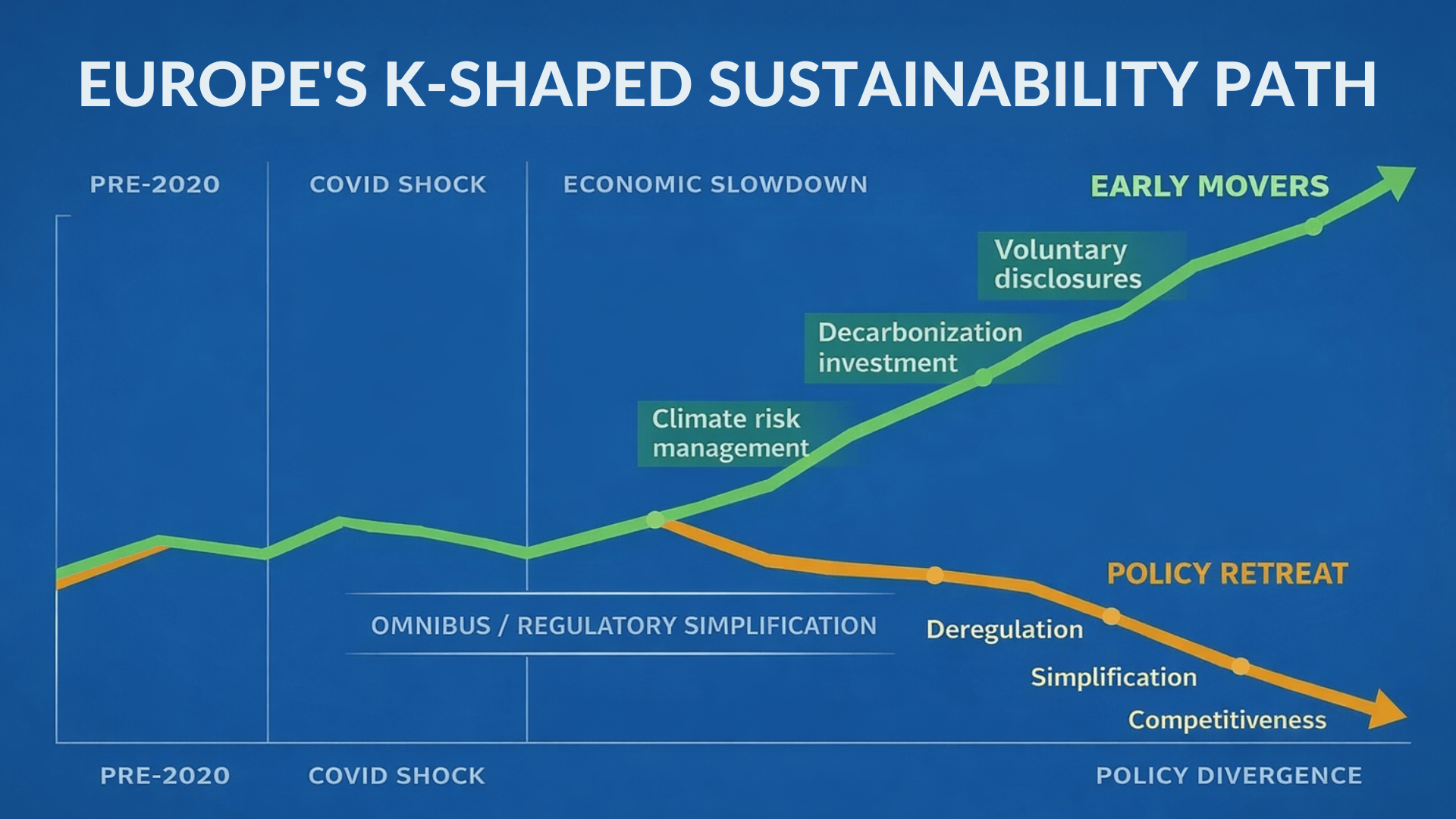

We are seeing this global turn toward adaptation for two main reasons. Firstly, because geopolitical headwinds are causing some nerves in the markets for new investment in heavy decarbonization tech, except for bright spots such as renewables. Secondly, 2050 is not a magic number. What the net-zero-by-2050 discussion misses is the volatility businesses are experiencing across their supply chains, markets, and operations today, which is driving investments in adaptation as an asset class.

3. COP30 could have been a pivotal moment for adaptation finance. What do you want to see more of from the COP process to unlock more funding, especially for the Global South?

The biggest adaptation gap today isn’t the political will or building an economic case, but knowing where to invest for the biggest return. If the COP process beyond COP30 wants to make adaptation investable, three elements matter most.

First, definitions. We need a shared global taxonomy for adaptation, what qualifies as adaptation, how success is measured, and what the ROI looks like. Without that, financiers can’t compare projects or understand what they are investing in. We need common playbooks that governments, Development Financial Institutions, and private investors can all use. The Global Goal on Adaptation, launched at COP21, began this work, but that effort has stagnated.

Second, finance frameworks. Investors, lenders, and insurers still lack transparent methods to quantify adaptation risk and reward. A unified standard would unlock blended and catalytic capital, especially for emerging markets that struggle to price risk today.

Third, innovation investment. In 2025, roughly $300 billion will be spent on AI infrastructure, mainly in the U.S. and China. Redirecting even 2% of that toward AI-for-climate applications in the Global South could mobilize $6 billion. That funding would not only strengthen local resilience but also position developing nations as creators of adaptation technology rather than just recipients of aid.

If COP30 can push these three levers—taxonomy, financial alignment, and innovation—it could finally make adaptation an asset class that attracts both public and private capital at scale.

4. AI is everywhere in climate tech now. What do business leaders most often get wrong about how AI actually drives better climate decisions, and what are companies leading in sustainable AI adoption doing differently?

Many executives see AI as a magic box that will somehow “solve” climate change. In reality, AI’s power lies in connecting vast datasets, such as weather, soil, supply chain, and consumer behavior, and turning them into actionable insights that improve decision-making and automate actions.

Another misconception is that AI’s environmental cost outweighs its benefits. It’s true that training large models uses a lot of energy, but the net impact depends on what the models enable. For example, optimizing irrigation timing or fertilizer use can reduce emissions and costs far more than the power consumed by the computation to make those decisions.

For companies looking to adopt AI for climate solutions, start with the problem and ask if it even requires AI. Then don’t just go for a big brand that offers you a billion or a trillion parameters that can solve any business problem. Our thinking is more about how we can create the simplest model with the fewest parameters to solve the specific problem and iterate on models from there towards a solution that gets us 95% there (at this point, the investments in the complexity of the model outweigh gains from it in terms of accuracy).

5. Looking ahead, where do you see the biggest opportunities for climate adaptation innovation? Are there specific sectors, geographies, or use cases that excite you most?

Agriculture remains the front line, because food systems are where climate volatility hits first. We are already seeing our AI-driven adaptation solutions drive ROI across agricultural value chains. But other sectors highly exposed to climate risks, like finance, are beginning to use climate intelligence to dynamically price loans and insurance coverage, rewarding companies that build resilience.

And going back to my taxonomy suggestion for COP, AI is an ideal tool for rapidly classifying assets against a shared adaptation taxonomy, identifying climate risks with far greater precision, and modeling potential outcomes. This helps close the measurement gap that drives up project costs in developing countries and enables evaluation of which interventions reduce risk most effectively, ensuring that the limited adaptation funding available is deployed where it delivers the highest return.

The broader opportunity is to build what I call an “adaptive economy”—one where an accurate understanding of the climate and how to work with it is as fundamental to decision-making as financial forecasting. The technology to enable this is improving every year. We just need to ensure adaptation tools are profitable, scalable, and inclusive.