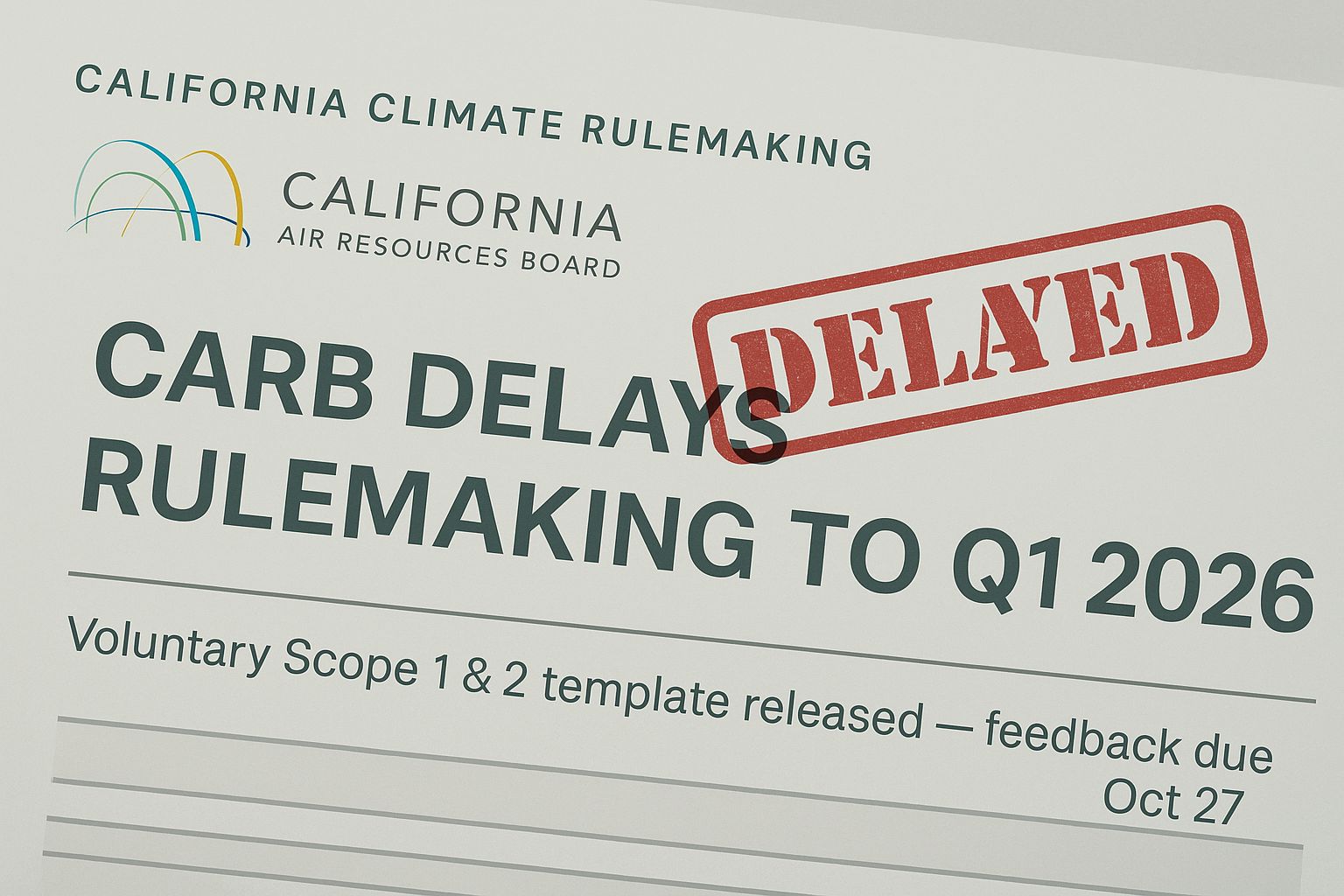

California Air Resources Board (CARB) delays climate reporting rule

European Parliament joins the deregulation push

Despite a campaign against it, renewables are booming

US threatens countries signing the maritime Net Zero Framework

A resurgence in climate tech investing

Initially scheduled for July 1, 2025, and then for December 12, 2025, the rules for California’s climate reporting laws have now been delayed until Q1 2026. The rulemaking draft, which outlines all the requirements for compliance, penalties, and other details, was not released on its scheduled delivery date of October 14th. Instead, the California Air Resources Board (CARB) released a note saying: “Given the large volume of public comments staff have received, and given ongoing input related to identifying the range of covered entities, CARB is proposing an updated timeline for bringing the initial rulemaking (including the fee-related provisions) to the board in Q1 2026.”

Based on the pattern of previous delays (reporting templates were 2 weeks late), a draft of the new rule could be expected in the next couple of weeks or early November. This would maintain the 45-day comment period, allowing the rules to be finalized in the first quarter of 2026.

The first quarter of 2026 extends until the end of March 2026 - more than five months from now. Given that the deadlines for filing climate risk reports begin in January 2026, the companies in scope (a list has been published by CARB here) will have to file reports before the rules are finalized. CARB’s previous guidance was that companies should use “best efforts” and submit reports based on commonly available disclosure frameworks.

In addition to announcing the delay, late last Friday (October 10th), CARB released a template for Scope 1 and 2 emissions reporting. The template is voluntary and designed to streamline the process for first-time reporters. Companies in scope must file a climate emissions report by June 30th, 2026, for Scope 1 and 2 emissions. Presumably, the CARB rule will be finalized by this date.

The template includes fields regarding the organization, its boundaries, Scope 1 and 2 emissions sources, materiality, methodologies, and assurance. In addition, it includes optional fields related to previous years' emissions.

CARB has requested feedback on the template - specifically on organizational boundaries, whether the template should include the emissions source and type of emissions, and whether it should include emissions reduction initiatives. You can submit feedback here by October 27th.

👉 Prefer to get Sustainability Simplified straight into your inbox instead of LinkedIn? Sign up to our email list here.

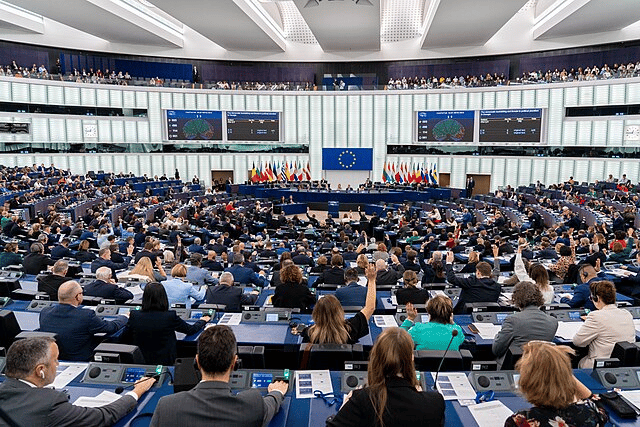

2. EU Parliament Piles on Deregulation Movement

After an EU Parliament legal affairs committee meeting (the JURI committee), it is all but confirmed that the EU Parliament’s position will align with massive cuts to the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). Pending a final plenary vote on October 20th, which is expected to go through without a hitch, all three parts of the EU trilogue are now locked into their positions. The debates and final votes are scheduled to take place in December.

It’s been a long and confusing road since the “Omnibus Simplification Package” was proposed back in February.

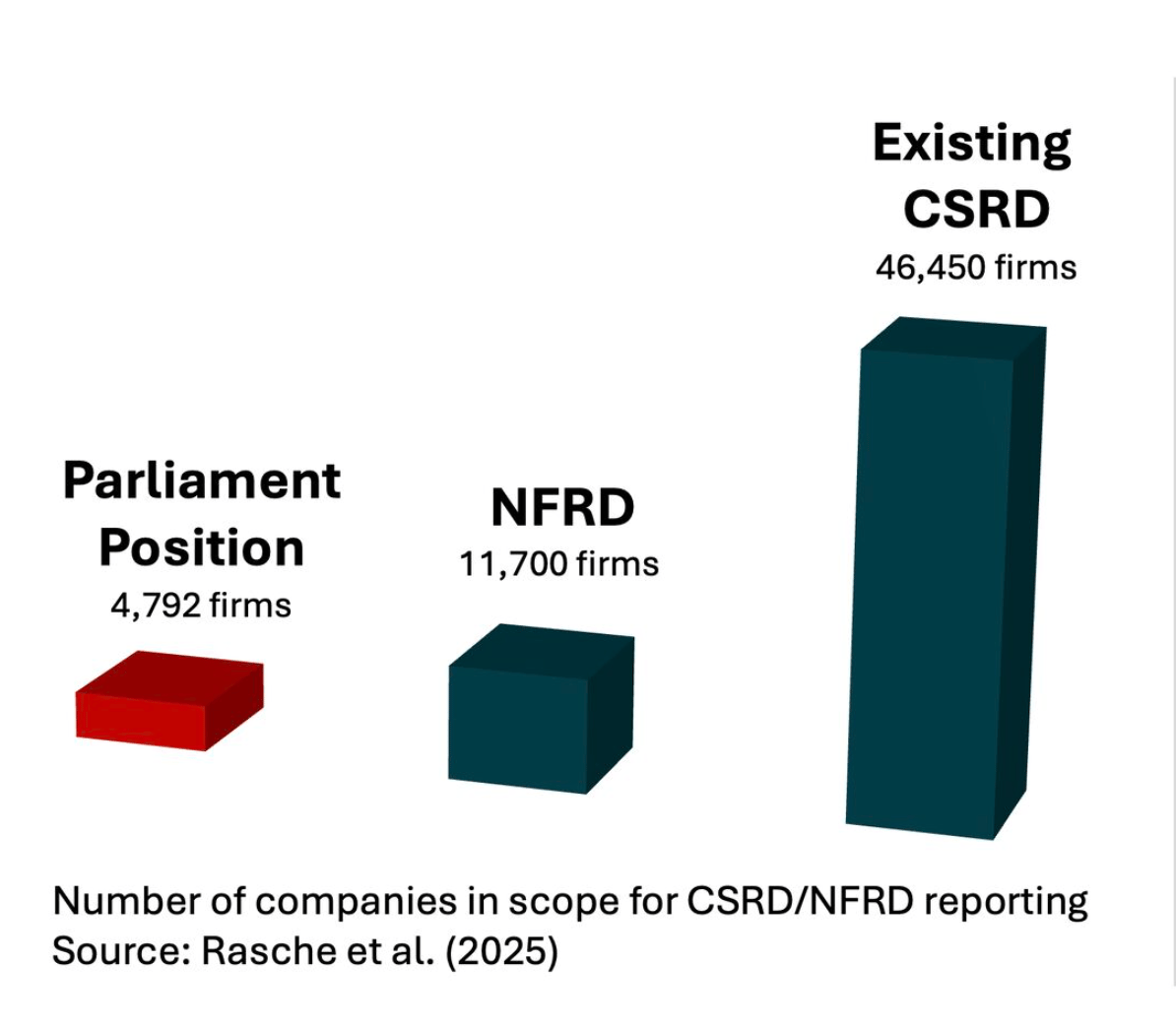

The most notable changes are now likely locked in as they are aligned across all three bodies:

The Corporate Sustainability Reporting Directive (CSRD) will cover 90% fewer companies (estimated at 50,000 companies originally, the new proposal will cover less than 5,000 companies). This means that the CSRD will impact fewer companies than the Non-Financial Reporting Directive (NFRD) it replaced, per the graph below from friend of the newsletter Andreas Rasche

The scope of the Corporate Sustainability Due Diligence Directive (CSDDD) is estimated to decrease by 70% from the original legislation. It will also limit the information gathered in the supply chain and eliminate civil enforcement options.

While this brings more certainty for companies preparing for compliance, multiple stakeholders have claimed that the scope reductions will undermine the usefulness of the rules.

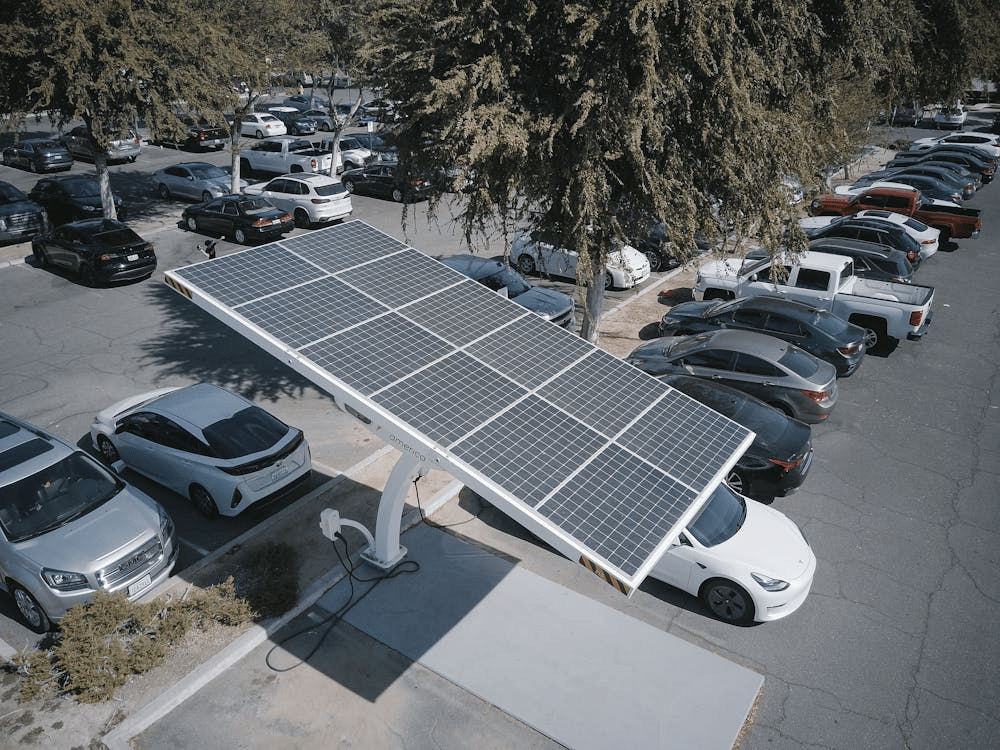

3. US Renewable Energy Booms

Despite the Trump administration's efforts to slow the adoption of renewable energy sources, next year could be a record year for adding new renewable energy and battery capacity.

Developers of wind and solar projects are in a mad rush to break ground on their projects before July 2026, when the tax credits cease. This rush is expected to result in an eye-popping 93% of new US energy capacity generated from renewable or battery-powered sources this year. And next year, the US forecast for renewable energy has been raised by 10%.

While lower prices for solar and batteries means that the majority of new capacity is renewable, after 2027 this boom will go bust. When the credits completely dry up, US renewables will slow down and energy prices will likely rise because fossil and nuclear sources take significantly longer to come online.

4. US Threats Over Maritime Carbon Tax

The UN’s International Maritime Organization (IMO) is meeting in London this week with the hope of finalizing the IMO’s “Net-Zero Framework.” The framework will impose a $100 per ton of CO2 emissions from ships exceeding 5,000 tonnes that emit more than a specified threshold.

Although the framework was agreed to back in April, the always complex multilateral agreements at the UN require two-thirds of the 176 members to agree to the rules before they can be implemented, starting in 2028.

IMO Secretary-General Arsenio Dominguez said, “Last April, we reached a compromise… based on years of negotiations, input, assessment, and analysis.” The EU is also urging its member states to back the plan, calling it “a vital step toward aligning global maritime activity with net-zero commitments.”

However, the US threatened countries that signed the framework with sanctions, visa restrictions for citizens, and increased port fees. With only around a dozen votes needed to block the agreement from April, the US threat could mean trouble for the updated treaty.

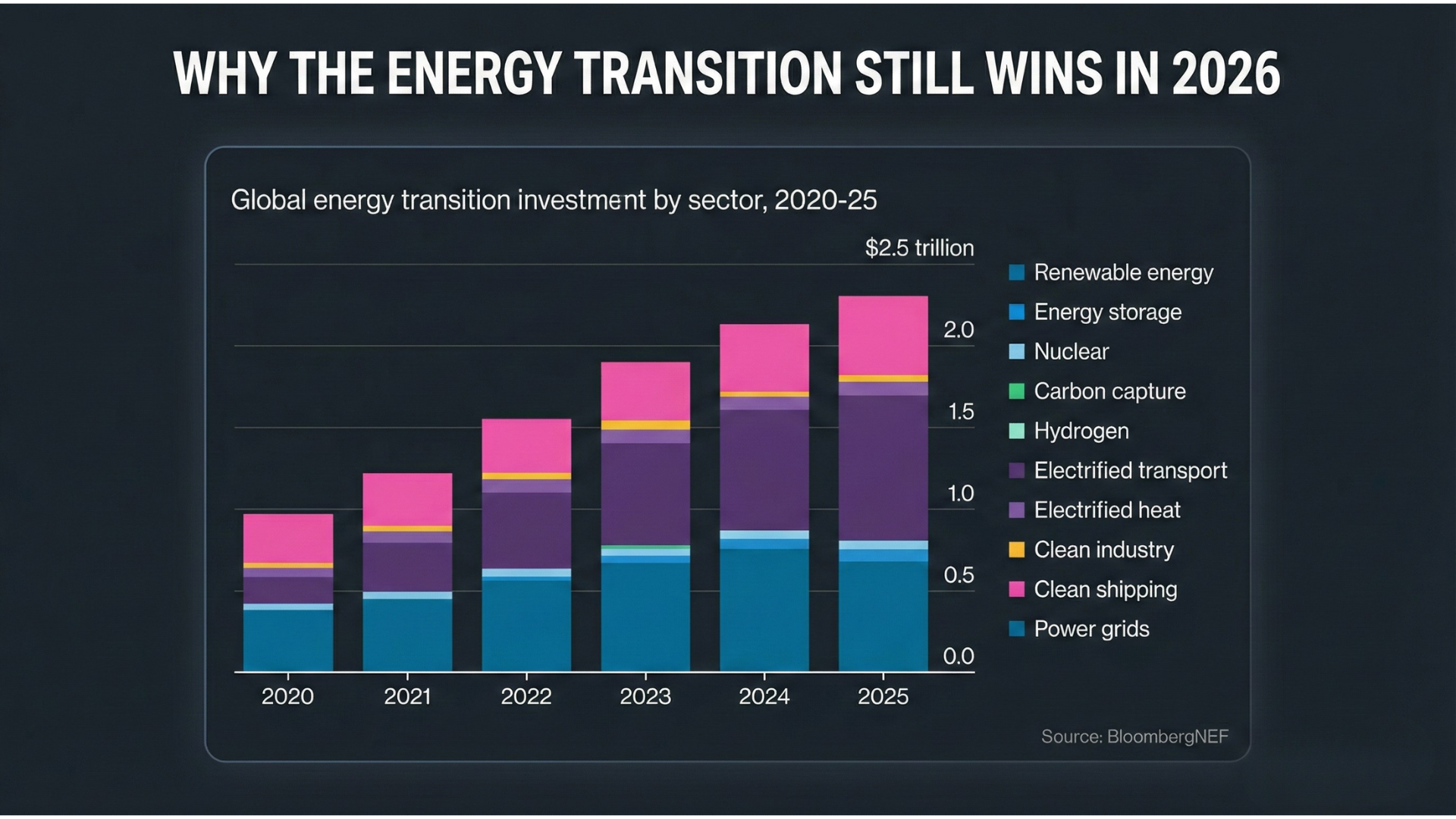

5. Cleantech Investing Surges

The first 9 months of 2025 have seen more public and private investments flood into clean technologies than in the whole of 2024. This bucks a three-year trend of declines in cleantech investing, after peaking in 2022.

The increase comes despite the Trump administration’s attack on clean technologies and was largely driven by Chinese cleantech firms such as EV maker BYD, battery makers, as well as nuclear energy for new data centers powering the AI boom.

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

EU Sustainability

AI and Sustainability

Global Weirding

California Environmental Rules

California Governor Gavin Newsom vetoed a law that would have limited the regulatory powers of air quality agencies at the nation's busiest port, and another that would have banned ‘forever chemicals’ in cookware.

COP30

Sustainable Aviation

Trump 2.0

Notable Podcasts:

This week’s episode of my colleague Vinay Shandal’s podcast, Pitching Progress, is all about tackling food waste. Vinay talks to Ryan Begin, CEO of Divert, a company tackling food waste where it happens most: in food service and retail.

This week’s episode of Frankly Speaking from Frank Bold features an interview with Andreas Rasche and Julia Otten. Together, they broke down the implications of the Omnibus text and explained what we can expect from the upcoming trilogues and Danish Presidency of the Council.