Reporting rules for non-EU companies delayed

EU Parliament aligns with the far-right on simplification drive

Huge milestones in the global energy transition

More US funding cuts for green projects

Net Zero Banking Alliance (NZBA) ceases operations

As Europe moves to simplify their regulations, this week they unveiled policies to be “de‑prioritised.” While hundreds of policies will be delayed, one stood out: Companies outside of Europe will catch a break from reporting under the Corporate Sustainability Reporting Directive (CSRD).

Technically, non-EU companies were supposed to adopt the European Sustainability Reporting Standards (ESRS) back in June 2024. Then, EU lawmakers pushed it to the end of June 2026. Now, with a delay until at least October 1st, 2027, non-EU companies can avoid reporting until at least 2029 (reflecting 2028 data).

The move comes after the Trump administration pushed back on requirements for American companies to report under the CSRD. It aligns with the recent EU-US trade deal, which included a commitment by the EU to ensure that the CSRD and Corporate Sustainability Due Diligence Directive (CSDDD) “do not pose undue restrictions on transatlantic trade.”

But the US is far from appeased. A new position paper asserted that US companies should be completely exempted from the CSDDD. The paper states that “countries with high-quality corporate due diligence” should be removed from the supply chain due diligence rule. Adding that the “extraterritorial reach, onerous supply chain due diligence obligations, climate transition plan requirements, and civil liability provisions will adversely impact the ability of US businesses to compete in the EU market.”

While the relief helps Europe with its trade deals, the European companies still subject to these laws may feel disadvantaged in the global market.

2. EU Parliament Aligns with Far-Right

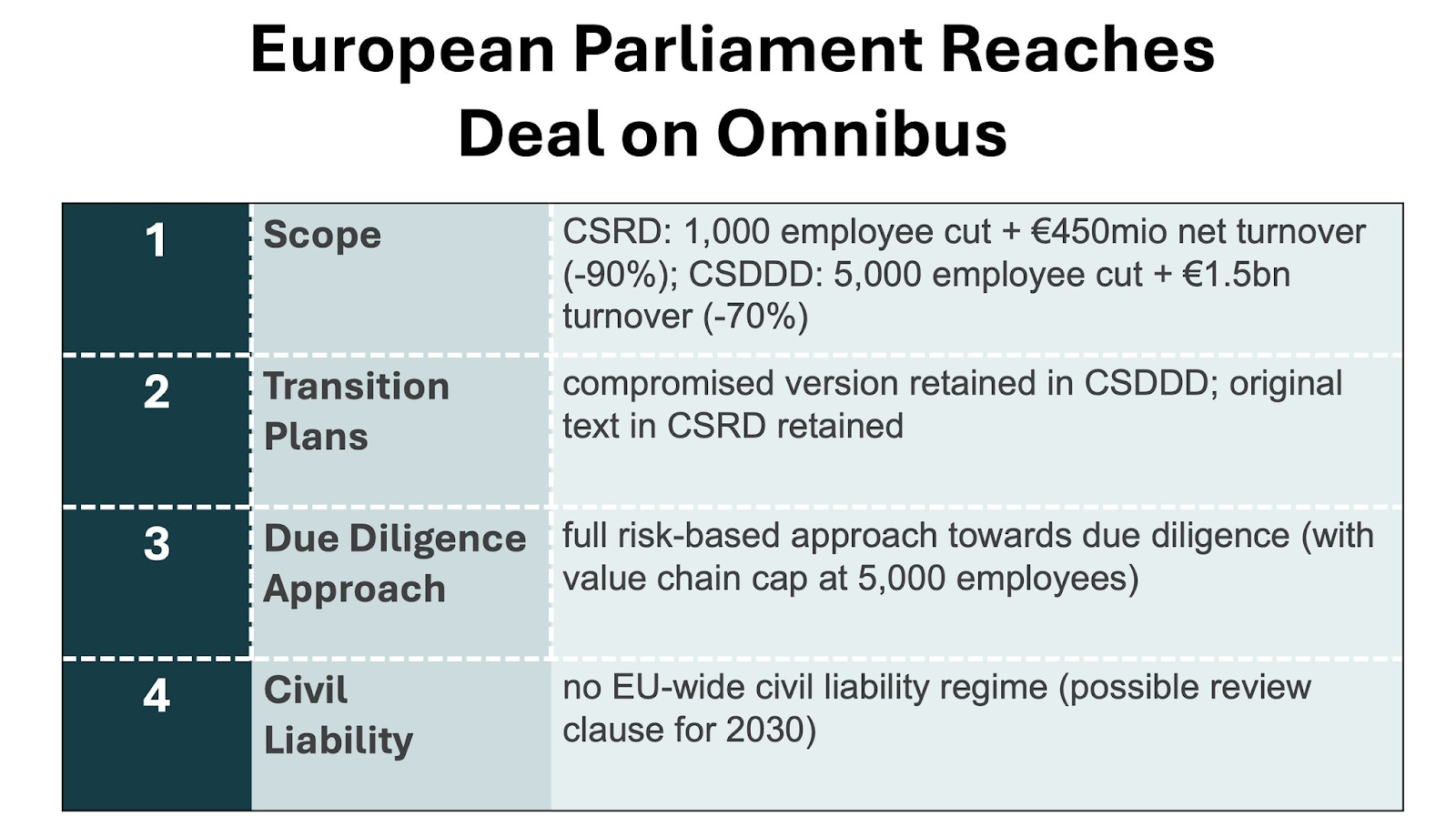

Perhaps in part due to US pressure, the European Parliament reached a debating position on the Omnibus simplification package this week that is very close to the far-right position.

The position adds a threshold for the CSRD of €450 million in revenue (up from €50 million) plus 1,000 employees - reducing the number of impacted companies by 90%. It would also increase the threshold for companies covered by the CSDDD to 5,000 employees (up from 1,000) - reducing the number of impacted companies by 70%.

Friend of the newsletter, Andreas Rasche, does a great job of summarizing the debating position in the table below:

h all of these changes coming quickly, it’s challenging to decode the impacts for you, dear reader. One take-home message is that companies with fewer than 1,000 employees will be exempted from reporting since all three EU bodies (Parliament, Council, and Commission) agree on this threshold. This change eliminates 90% of the previously covered companies.

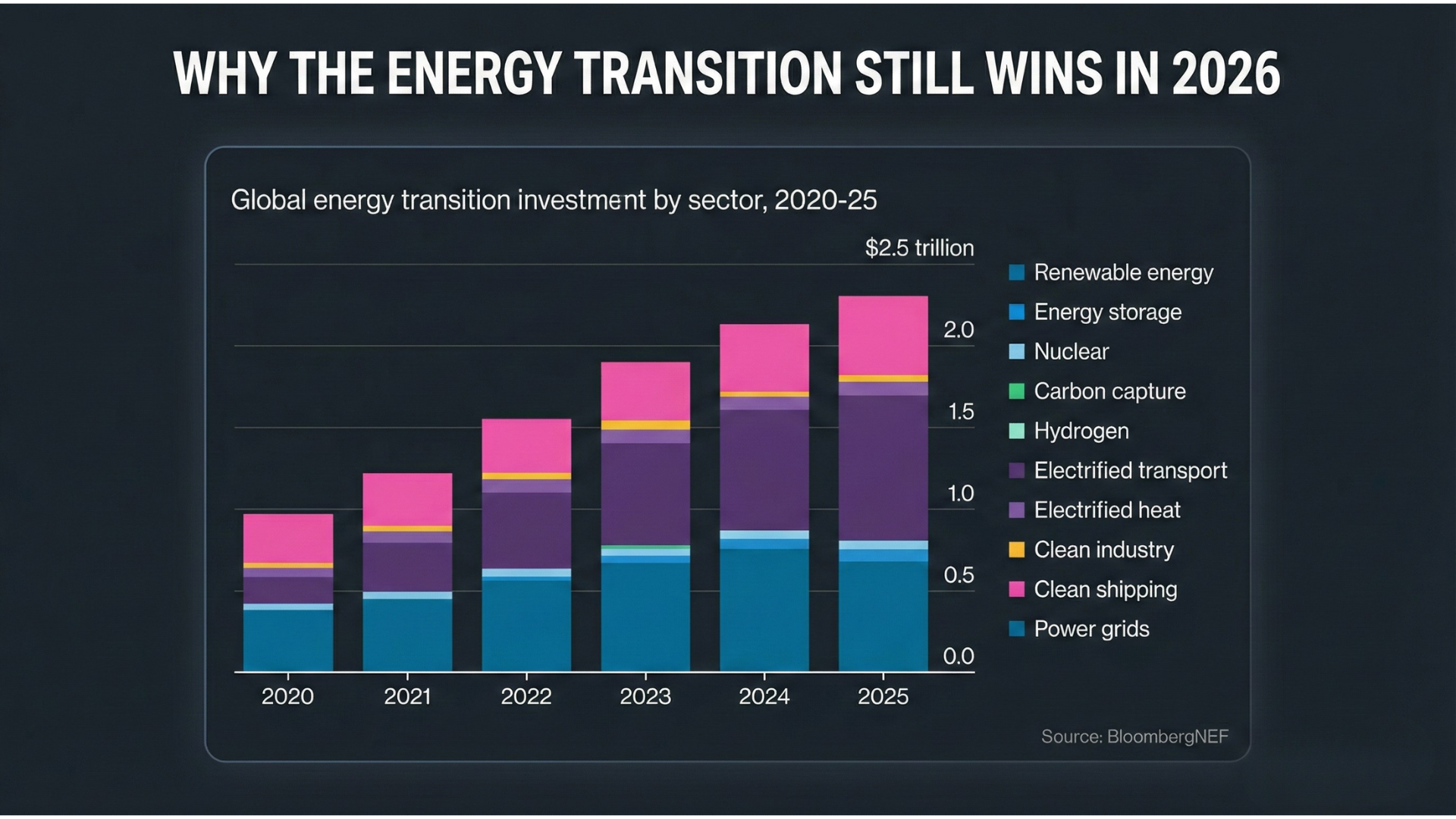

3. Massive Milestones for Energy Transition

While the Trump administration has sought to limit the adoption of renewable energy in the US, the global transition is still moving forward at full steam.

The International Energy Agency (IEA) released its annual Renewables Report this week, downgrading its forecast for US clean energy production by 50% compared to last year. The new estimate is for the US to add 250 GW of new renewable energy capacity by 2030, compared to last year's forecast of 500 GW. The main reasons for the downturn are the Trump administration's “One Big Beautiful Bill Act,” the dropping of renewable tax credits, and the suspension of wind energy leases.

However, the US backtrack and a slight downturn in China’s forecast were offset by predictions for Europe, India, and other economies. This resulted in global estimates just 5% less than last year, which still puts renewable energy capacity on pace to double by 2030.

Additionally, a report from energy think tank Ember this week found what Sonia Dunlop, of the Global Solar Council, called a “historic shift,” marking the first time that renewables produced more energy than coal. Solar and wind adoption, also for the first time, outpaced the increase in demand.

These two reports contribute to the mounting evidence against any talk of a slowdown in 2025. According to Małgorzata Wiatros-Motyka, an author of the Ember report, this is “A crucial turning point, solar and wind are now growing fast enough to meet the world’s growing appetite for electricity.”

4. More US Clean Energy Cuts

Next year’s IEA report may see a further downgrade of US renewable capacity as the Trump administration looks to cut an additional $12 billion in funding for clean energy projects. That comes after more than $7.5 billion in cuts were announced last week following the government shutdown. When combined with other cuts from earlier in the year, the total reduction to green project funding reaches $24 billion.

While the cuts focus on Democrat-led states, the new list of terminated contracts also includes projects supported by Republicans, like two direct air carbon capture projects in Texas and Louisiana.

The legality of these canceled funds has already been challenged by a coalition of solar energy companies, labor unions, nonprofits, and homeowners, who are suing the Environmental Protection Agency to restore the $7.5 billion cut announced last week, citing the need for Congressional approval.

5. Net Zero Banking Alliance Shutters Operations

Friday, members of the Net Zero Banking Alliance (NZBA) decided to disband the group, saying, “As a result of this decision, NZBA will cease operations immediately.”

The decision follows an exodus of high-profile members and softening the membership rules in April 2025 (e.g., downgrading the mandatory 1.5°C climate alignment to a recommendation). The group will continue as a framework for net zero banking and released updated “Guidance for Climate Target Setting for Banks.”

Andrew Howell, of the Environmental Defense Fund, said, “There has been a pivot away from aspirational target setting towards a focus on concrete projects and the complex financial mechanics needed to make them happen and scale them.”

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

Nature Reporting

The Taskforce on Nature-related Financial Disclosures (TNFD) released its first progress report this week. More than 500 companies are already reporting in over 50 countries. 63% of those surveyed believe their nature-related issues are as significant, or more important, than climate-related issues. 78% of reporting companies have integrated their climate and nature reporting.

Also this week, the International Organization for Standardization (ISO) announced a new standard aligned with the TNFD framework for organizations to assess and address their biodiversity impacts, dependencies, risks, and opportunities. The “ISO 17298: Biodiversity for organizations” is meant to fill a gap and give guidance to companies to understand their biodiversity risks, identify opportunities for green growth, and develop and implement a credible biodiversity action plan.

Carbon Markets

Climate Diplomacy

Sustainability Regulations

Climate Litigation

Sustainability Research

A study finds that the global food system could feed 10 billion people and halve emissions by 2050, but it will never be emissions-free.

Trump 2.0

Notable Podcasts:

This week’s episode of the Outrage and Optimism podcast takes a look at COP30. With only a few weeks to go until this year’s COP, this episode looks at how COPs are structured, who runs them, and how this one is different.

In the most recent episode of Joel Makower and Solitaire Townsend’s "Two Steps Forward," an interview with IKEA CEO Jesper Brodin is featured. This episode, recorded live at New York Climate Week, explored the role of corporate leaders in accelerating the sustainability transition.