A new carbon accounting standard is finalized, while a competing scheme comes under fire as a ploy to dilute and delay climate action

Rare progress on US climate action policies

The British Financial Conduct Authority proposes new sustainability reporting rules

Europe reframes its Circular Economy rules toward security and competitiveness

Three US courts block sustainability rollbacks

This week, the GHG Protocol released the Land Sector and Removals Standard (LSR).

The standard will help companies measure how land use in agriculture and other sectors both produce and remove emissions. It will also provide companies with an accurate way to measure and report technological CO2 removals (e.g., carbon capture, direct air capture).

The rules are designed to address a critical gap in accurately measuring emissions from land use, which account for ~25% of global emissions. It will help entities that directly engage in land-based activities in their operations and value chains measure and report their emissions and removals. It defines strict safeguards for removals and sets out requirements for ongoing monitoring to ensure that emissions are not re-released into the atmosphere.

One glaring omission from this standard was forestry, which has been deferred to a future version of the standard, much to the chagrin of the forestry products industry. An independent advisory board working to resolve issues around forestry measurements failed to do so, resulting in one such advisor, Nathan Truitt, of the American Forest Foundation saying, “It’s a shame GHGP couldn’t manage to accept what its stakeholders were telling it, but that doesn’t mean we have to stop. We now know how to do this right, I don’t think we need permission from the GHGP!”

The GHG Protocol will release additional guidance in the coming months to help companies implement the standard, ahead of its January 1, 2027, effective date.

Do We Need Another Carbon Accounting Standard?

While the GHG Protocol continues to harmonize and update carbon accounting standards through its new partnership with the International Organization for Standardization (ISO), there are growing concerns that a new Exxon-backed carbon accounting standard could fragment the carbon accounting landscape.

The new body - Carbon Measures led by Amy Brachio (former Vice Chair EY) - proposes a product-level ledger format, pioneered by the E-ledgers Institute - led by two academics Karthik Ramanna (Oxford) and Robert Kaplan (Harvard). In this system, each entity in the value chain only calculates its own emissions (Scope 1) and inherits the “embedded” emissions from the suppliers of its ingredients and providers of energy. By adding up the incoming carbon from its suppliers and electricity providers with the carbon from its own operations, each company develops a total that is then allocated to each product it produces. This “carbon ledger” is then handed on to their customers.

The idea relies on full cooperation from all entities across the value chain to provide accurate emissions estimates for their products. If there is noncompliance, the offending company is slapped with a massively high emission factor until they get on board. The system is intended to add up all the carbon necessary to make a product until it is sold to an end consumer (downstream emissions), at which point there would be no further measurement nor accountability for the emissions.

In the case of oil and gas companies, downstream emissions account for ~80-90% of total emissions. Exxon’s argument has been that they cannot control the use of their products (i.e., fuel) and thus cannot influence the reduction of these emissions. While this may be the case for gasoline, other industries (e.g., electronics) have made tremendous strides in managing downstream emissions through designing energy-efficient technologies.

In a recent WSJ article debating the pros and cons of the new standard, Carbon Measures CEO Amy Brachio argues that this type of accounting is essential for driving demand of low carbon products, saying “Corporations that have invested in low-carbon emission products and services aren’t seeing sufficient demand, and if we don’t solve this demand problem, we’re not going to see the progress that we need to see with respect to emissions reductions.”

However, a joint statement this week from business leaders, such as former Unilever CEO Paul Polman and former BP CEO John Brown, states: “Full value-chain visibility – including Scope 3 emissions – is essential for credible transition planning, investors’ fiduciary duty, and forward-looking assessments of climate risk.” They do acknowledge the need for product-based accounting and urge Carbon Measures to join the GHG Protocol and ISO in their ongoing standard-setting process for product-level carbon accounting, which Brachio said she would be amenable to, but would not “harmonize for harmony’s sake.”

An even more cynical view of Carbon Measures was expressed in an FT article, which claimed that the impracticality of the e-ledgers system, which would require participation by thousands of companies across value chains, is by design. It cites an analysis from BankTrack, which claims Carbon Measures falls “neatly” into “Exxon’s history of favouring approaches that delay climate action.”

The carbon accounting world has seen more action in the last six months than in the previous 20 years. While change can be good, too much can muddy the waters, resulting in a less comparable, consistent, and accurate landscape of metrics, slowing action. Only time will tell how the 10 product emissions standards Carbon Measures is developing will be received. Let us hope harmony prevails.

2. Rare Win for US Climate Policy

The biggest surprise in last week's news was that the 2026 Energy Appropriations Act included funding for carbon removal technologies and a study on the carbon intensity of products imported to the US. The bipartisan bill included funding for a range of carbon capture and storage (CCS) projects and programs. Toby Bryce, of the Yale Center for Natural Carbon Capture, said, “It’s great to see continued bipartisan Congressional support for CDR research, innovation, and early deployments. These investments are essential to scaling carbon removal.”

The Providing Reliable, Objective, Verifiable Emissions Intensity and Transparency (PROVE IT) Act, also in the bill, requires the Department of Energy to conduct a study of U.S. manufacturing’s carbon intensity relative to trade competitors. The goal of the study, due next January, is to calculate the carbon emissions associated with covered goods (high-carbon intensity goods such as steel and cement) imported to the US. The Energy Department would then compare the carbon intensity with the same goods made in the US. This is nearly identical to Europe’s Carbon Border Adjustment Mechanism (CBAM) except for taxing the difference in carbon intensity.

The US climate policy landscape has changed drastically in the last year, with the Trump Administration rolling back several foundational policies such as emissions reporting, clean tech incentives, and the “endangerment finding.” However, trade and carbon data may still play a role, as this insightful article outlines.

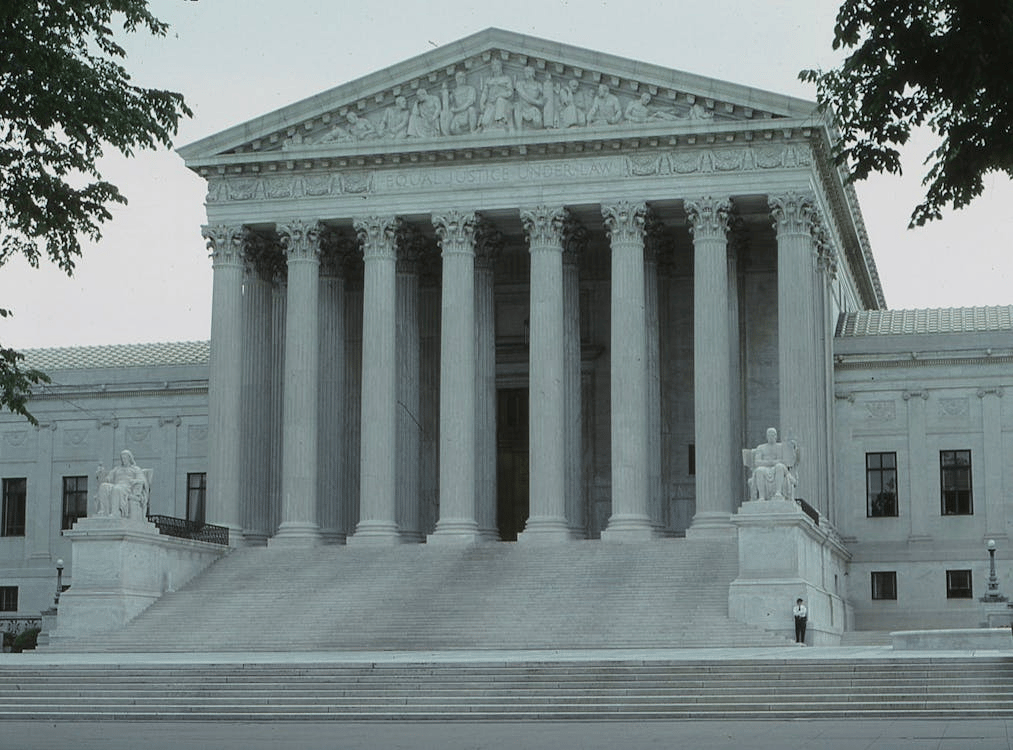

Also, if the Supreme Court strikes down Trump’s authority to impose tariffs, it will remove his bargaining chip to get an exemption from Europe’s carbon tariff (CBAM). This could force the US to enact its own carbon tariff (though Congress) to level the playing field with Europe.

3. UK Expands Sustainability Reporting

The UK’s Financial Conduct Authority (FCA) announced proposals last week to replace and expand its current mandated climate disclosure rules. The main change is to align disclosures with the International Sustainability Standards Board (ISSB) standards. The prior rule aligned with the Taskforce on Climate-related Financial Disclosures (TCFD), which merged into the ISSB in 2023.

The new proposal expands the current climate reporting rules to include comprehensive sustainability reporting under the UK’s Sustainability Reporting Standards (SRS), which are aligned with ISSB’s standards. The new rules would require UK-listed companies in scope to:

Comply with the SRS S2 climate-related standard in year 1, excluding Scope 3 (value chain emissions), which will be mandatory on a “comply or explain” basis the year after.

Reporting to the SRS S1 sustainability-related standard will also be on a “comply or explain” basis, given the inexperience of listed companies in reporting broader sustainability risks and opportunities.

Climate transition plans are also to be reported on a “comply or explain” basis.

The FCA is requesting comments on the consultation, which is open until 20th March 2026, ahead of finalizing the rules in late 2026.

4. EU’s Circularity Act Pivots to Security

Against the backdrop of Europe’s attempt to shore up both energy and material security amid trade wars, a briefing from the EU Parliament last week provided a crucial update on its Circular Economy Act (CEA) - which will be final by the end of 2026.

The overall aim of the CEA is to make the EU a world leader in circularity and double existing circularity rates from 12% to 24% by 2030. It also includes an EU market for secondary raw materials and, on the demand side, a public procurement policy. But underlying this goal, as the briefing spells out, is reducing the EU’s dependency on imports, increasing material security, boosting competitiveness, and building a more sustainable economy.

This is indicative of the EU’s new direction on sustainability, one that is more focused on security, economics, and competitiveness.

5. US Courts Block Climate Rollbacks

This week, three opinions taken together show the limits of the Republican-led rollbacks to climate action and policy.

The views expressed on this website/weblog are mine alone and do not necessarily reflect the views of my employer.

Other Notable News:

Sustainability Research

SBTi

Energy Transition

Greenwashing

Climate and AI

Notable Webinars and Podcasts:

In this week’s episode of the Outrage and Optimism podcast, the team asks what a new era of climate leadership led by China will look like. They speak to an expert on China’s clean energy dominance about what this recalibration of climate geopolitics will mean, China’s growing role in the developing world, and how China wants to lead.

In the latest edition of Two Steps Forward, Joel Makower and Solitaire Townsend argue that climate denial isn’t the biggest issue right now. It's silence. Although the Trump administration is rolling back climate programs, the public still wants climate action. The real damage is being caused by the business leaders who remain silent.